An Integrated STEM and Tax Accounting Equation Framework for Investigating Underground Economy Activity

Jakarta, taxjusticenews.com:

I. Executive Summary: An Integrated Approach to Unmasking the Underground Economy

Underground Economy Activity (UEA) presents a significant and persistent challenge to the fiscal integrity of nations worldwide, eroding the tax base and undermining fair economic competition. This unreported or illicit economic activity, ranging from undeclared income to black market operations, deprives governments of crucial revenue needed for public services and can have detrimental effects on the formal economy. Addressing this complex issue requires innovative and multifaceted strategies that move beyond traditional enforcement methods. This report proposes an integrated framework that combines the power of Science, Technology, Engineering, and Mathematics Collaboration Empowering Law enforcement (STEM CEL) with the analytical rigor of a Tax Accounting Equation framework, enriched by the functionalities of a Self Assessment Monitoring System (SAMS) and a Core Tax Administration System (CTAS), to deeply investigate and ultimately mitigate Underground Economy Activity. This integrated approach leverages the data-driven insights and technological capabilities inherent in STEM fields within law enforcement, enhanced by the comprehensive data management and analytical tools of modern tax administration systems, and guided by the fundamental principles of accounting to identify financial irregularities indicative of UEA. The report will explore the synergistic potential of these components, outlining practical applications and offering recommendations for government agencies seeking to strengthen their efforts against the underground economy.

II. The Convergence of STEM and Law Enforcement: Empowering the Fight Against Crime

-

Leveraging Data Analytics and Mathematical Modeling for Crime Pattern Identification. STEM-focused training is increasingly recognized as a vital component of modern law enforcement, equipping officers with the analytical skills necessary to navigate the complexities of contemporary crime. This training includes crucial areas like data analysis, statistics, probability, and algorithms, enabling law enforcement professionals to interpret intricate information and make well-founded decisions based on evidence rather than assumptions. The ability to apply mathematical reasoning and data analysis allows officers to move beyond traditional investigative techniques and develop informed strategies for crime prevention and resource allocation. With access to substantial volumes of real-time data, law enforcement agencies can now identify crime hotspots, predict potential patterns, and distribute their resources with greater efficiency, leading to more effective policing. The FBI acknowledges the essential role of mathematics and data professionals within their ranks, utilizing their expertise for both predictive analysis to anticipate future threats and investigative analysis to understand past criminal activities. Similarly, the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) employs forensic auditors who meticulously examine extensive datasets and crime scene evidence to uncover financial motives behind criminal acts and trace the flow of illicit proceeds. Furthermore, contemporary applications of mathematics in law enforcement extend to the development of data extraction programs designed to analyze police reports for patterns of behavior, including potential biases, allowing agencies to proactively address issues before they escalate. The rise of data-driven policing signifies a fundamental shift in how law enforcement approaches its duties, utilizing data from diverse sources, such as publicly available information and sensor networks, to determine not only where crimes are currently occurring but also where they are likely to happen in the future. This analytical approach enhances an agency’s capacity for both preventing crime before it occurs and allocating resources strategically to maximize their impact.

-

The Role of Technology in Modern Policing: Digital Forensics, Cybersecurity, and Surveillance. The integration of Science, Technology, Engineering, and Mathematics (STEM) into law enforcement training curricula is a transformative shift in modern policing. This transition encompasses training in critical technological areas such as digital forensics, the operation of GPS and drone systems, and cybersecurity. Digital forensics, in particular, is revolutionizing how crimes are solved by enabling officers to gather vital evidence from digital devices and online platforms, uncovering digital footprints that might otherwise remain hidden and facilitating the recovery of data that has been erased. A comprehensive understanding of concepts like encryption, malware, and digital footprints is becoming increasingly essential for strengthening investigations and proactively preventing future cyber threats and security breaches within law enforcement systems. During critical situations like vehicle pursuits, law enforcement agencies are increasingly relying on technological tools such as GPS tracking darts, thermal imaging cameras, and aerial drones to monitor suspects from a safe distance. Additionally, the use of spike strip deployment systems and real-time traffic data applications helps to minimize the risks associated with such high-stakes scenarios. The FBI recognizes the critical importance of technology professionals who possess expertise in areas like computer technology, cyber security, electronic surveillance, biometrics, and encryption to safeguard sensitive information and maintain the integrity of their operations. Furthermore, advancements in artificial intelligence (AI) are also being leveraged to enhance policing capabilities, such as AI-powered systems that can significantly shorten the time required to review video evidence from body cameras by automatically identifying key zones of activity. Facial recognition technology, another application of AI, can assist law enforcement in identifying individuals who have outstanding warrants for their arrest, further demonstrating the transformative potential of technology in modern policing.

-

Enhancing Investigative Capabilities through Engineering and Scientific Innovations. STEM innovations are playing an increasingly significant role in enhancing the capabilities of law enforcement agencies across a wide spectrum of their operations. For instance, the application of 3D modeling techniques, rooted in engineering principles, is aiding in more accurate and comprehensive crash reconstructions, strengthening the legal processes for both victims and defendants. The ATF offers diverse career paths in forensics and STEM fields, with its National Laboratory Center serving as a central hub for scientific research and housing specialized facilities like the Fire Research Laboratory and the National Firearms Examiner Academy. The agency employs a range of STEM professionals, including electrical and fire research engineers who investigate fire and explosion incidents, fingerprint specialists who analyze forensic evidence, forensic auditors who examine financial records, and forensic biologists and chemists who utilize cutting-edge technology to analyze biological and physical evidence from crime scenes. The FBI also relies heavily on scientific analysis, with forensic scientists and staff within its Laboratory Division utilizing a multitude of scientific techniques, such as cryptanalysis, document analysis, trace evidence examination, latent print analysis, and chemistry, to help solve complex cases. Moreover, the Department of Homeland Security’s (DHS) Science and Technology Directorate (S&T) is actively involved in delivering new and innovative capabilities to law enforcement, such as the DepLife™ technology, which enables officers to detect the presence of individuals inside a room even when they lack a direct line of sight. Additionally, S&T is collaborating with federal law enforcement partners to develop and deploy data-driven analytic tools designed to combat transnational crime, including areas like human trafficking, fentanyl smuggling, and child exploitation. These advancements underscore the critical role of engineering and scientific innovation in equipping law enforcement with the tools necessary to address the evolving challenges of modern crime.

III. Modernizing Tax Administration: The Power of CTAS and SAMS

-

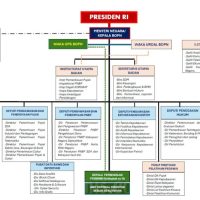

Understanding the Architecture and Capabilities of Core Tax Administration Systems (CTAS). The Core Tax Administration System (CTAS) represents a significant modernization initiative within the Indonesian Directorate General of Taxation (DGT), designed as an integrated service administration system to streamline all fundamental tax administration processes. This comprehensive system encompasses critical functions such as taxpayer registration, the processing of tax return reporting, the management of tax payments, the execution of audits, and the handling of collections. The overarching goal of CTAS is to establish a tax administration framework that is characterized by ease of use, robustness, integration across various functions, accuracy in its operations, and overall reliability. This initiative is a key component of Indonesia’s ongoing tax reform efforts, involving a substantial re-engineering of existing business processes through the implementation of commercial off-the-shelf (COTS) information systems and a fundamental rearrangement of the tax database. The primary objectives driving the implementation of CTAS include a significant increase in tax revenues, achieved through the improvement of taxpayer compliance rates and the more effective identification of taxpayers who are not fulfilling their tax obligations. Furthermore, CTAS aims to bring about a unified view of all taxpayers within the DGT, providing a holistic and integrated perspective on taxpayer data and activities. A critical aspect of CTAS is its focus on reducing the administrative burden associated with tax administration, primarily by minimizing the reliance on paper-based processes and enhancing the accessibility of taxpayer information through digital platforms. The system is designed to provide intuitive electronic channels that facilitate seamless interaction between taxpayers and the DGT. Ultimately, CTAS will integrate a total of 21 key tax business processes currently carried out by the DGT, spanning the spectrum from taxpayer services and supervisory functions to law enforcement activities aimed at ensuring taxpayer compliance.

-

The Functionality and Role of Self Assessment Monitoring Systems (SAMS) in Tax Compliance. The Self Assessment Monitoring System (SAMS) serves as a vital tool within the Internal Revenue Service (IRS) in the United States, specifically utilized by the Taxpayer Advocate Service (TAS). SAMS functions as a comprehensive database that collects and prioritizes systemic issues and problems reported by both IRS employees and the general public. Its primary role is to help the TAS address significant, overarching problems within the IRS or the broader tax law that have an impact on multiple taxpayers, rather than isolated issues affecting single individuals. Through SAMS, all IRS employees and external stakeholders have a mechanism to submit issues related to fundamental taxpayer rights, the reduction of undue taxpayer burden, the assurance of fair treatment in tax matters, and the provision of essential taxpayer services. Systemic Advocacy, a distinct function within the TAS, relies on SAMS as its central platform for receiving and prioritizing systemic issues that warrant development into advocacy projects aimed at benefiting large groups of taxpayers. As such, SAMS acts as the primary database for recording, managing, and tracking all activities associated with Systemic Advocacy projects, including the formation of task forces, the review of Internal Management Documents (IMDs), and the management of advocacy portfolios.

-

Harnessing Technology for Efficient Tax Data Management and Risk Assessment. The application of digital technologies holds immense potential for revolutionizing tax collection across three key areas: accurately identifying the tax base, effectively monitoring taxpayer compliance, and significantly facilitating the process of compliance for taxpayers. The concept of Tax Administration 3.0 embodies this technological shift, emphasizing the reliance on digital technologies to enhance the efficiency, transparency, and overall inclusivity of tax systems. Emerging technologies, including sophisticated data analytics, cloud computing infrastructure, artificial intelligence (AI) capabilities, and blockchain technologies, are at the forefront of this digital transformation within tax administrations. AI, in particular, offers a wide array of advantages to the tax domain, with the potential to automate routine processes related to tax compliance, improve the identification and assessment of tax risks, streamline the analysis of transactional tax data, enable near real-time compliance monitoring, and automate numerous manual and repetitive tasks. Recognizing the transformative power of technology, tax administrations worldwide are increasingly adopting technology-driven solutions to improve their core operational functions and enhance the efficiency of revenue collection processes. Modern data analytic tools play a crucial role in this modernization, empowering tax authorities to monitor and enforce compliance more effectively through the implementation of automated cross-checks that compare self-reported tax liabilities against a multitude of other available data sources. Furthermore, foundational digital technologies and services, such as electronic registration of taxpayers, electronic filing of tax returns, electronic payment systems, electronic invoicing, and the use of electronic fiscal devices (EFDs), are becoming increasingly integral to modern tax administration, with their adoption rates varying based on the level of economic development and the specific types of taxes being administered. These technological advancements are not only improving the efficiency of tax operations but are also contributing to tangible gains in tax revenue by enhancing overall taxpayer compliance.

IV. The Tax Accounting Equation Framework: A Lens for Detecting Financial Irregularities

-

Deconstructing the Fundamental and Expanded Accounting Equations. At the heart of financial accounting lies the fundamental accounting equation, a principle stating that a company’s total assets must always equal the sum of its liabilities and its owners’ equity (Assets = Liabilities + Equity). This equation serves as the bedrock of the double-entry accounting system, a method where every financial transaction is recorded in at least two different accounts, ensuring that the equation remains in balance at all times. Assets represent the valuable resources that a company controls and expects to provide future economic benefits, while liabilities are its obligations to external parties, and equity represents the owners’ residual claim on the company’s assets after deducting liabilities. This straightforward relationship is considered the foundation upon which all financial analysis and reporting are built. To provide a more detailed understanding of the equity component, the expanded accounting equation breaks it down further into its constituent parts: Assets = Liabilities + Owner’s Capital + (Revenues – Expenses – Withdrawals). Here, Owner’s Capital represents the initial investment by the owners, Revenues are the income generated from the company’s operations, Expenses are the costs incurred to earn that revenue, and Withdrawals (or Dividends in the case of corporations) are the distributions of profits to the owners or shareholders.

-

Applying the Framework to Identify Discrepancies and Anomalies in Financial Reporting. The fundamental accounting equation serves as a crucial mechanism for ensuring the accuracy and reliability of financial reporting by establishing that every transaction must maintain the balance between a company’s assets and the sum of its liabilities and equity. This principle ensures that all entries in the books and records are systematically vetted, creating a verifiable link between each liability or expense and its corresponding source, as well as between each item of income or asset and its source. Consequently, any imbalance in this equation can serve as a significant indicator of a potential error in bookkeeping or, more seriously, an intentional misrepresentation of a company’s financial position. To further scrutinize financial reporting for irregularities, analysts and auditors often employ financial statement analysis techniques, including vertical and horizontal analysis. Vertical analysis involves expressing each item in the financial statements as a percentage of a base figure (like revenue for the income statement or total assets for the balance sheet) to identify significant year-over-year changes that might warrant further investigation. Horizontal analysis, on the other hand, focuses on the percentage change in each financial statement line item over time, highlighting any unusual trends or variations that could be red flags for potential fraudulent activities. Additionally, comparative ratio analysis plays a vital role in spotting accounting irregularities by examining key financial ratios, such as profit margins and liquidity ratios, and comparing them against industry benchmarks or the company’s own historical performance. Significant deviations from these norms can indicate potential manipulation of financial statements or other accounting improprieties.

-

Potential Adaptations of the Tax Accounting Equation for UEA Analysis. Recognizing the unique challenges posed by tax evasion and the underground economy, Dr. Joko Ismuhadi, an Indonesian tax specialist, introduced the Tax Accounting Equation (TAE) as a novel tool for detecting financial irregularities. TAE strategically rearranges the basic accounting equation into two interrelated formulations: Revenue – Expenses = Assets – Liabilities, and Revenue = Expenses + Assets – Liabilities. These adaptations place a deliberate emphasis on revenue as a critical indicator of a company’s economic activity and its consequent tax obligations. By focusing on the relationship between a company’s profitability, as reflected in the income statement (Revenue – Expenses), and its net worth, as shown on the balance sheet (Assets – Liabilities), TAE aims to provide tax authorities with a more targeted lens for identifying potential tax irregularities that are often associated with the underreporting of income. Furthermore, for specific scenarios where taxable income might be intentionally reported as zero or even negative to minimize tax liabilities, Dr. Ismuhadi also formulated the Mathematical Accounting Equation (MAE): Assets + Dividen + Beban = Kewajiban + Ekuitas + Pendapatan (where Beban translates to Expenses and Kewajiban to Liabilities in Indonesian). The fundamental mathematical principle underlying both TAE and MAE is to establish an expected equilibrium between key financial reporting components and a company’s tax obligations. Significant deviations from these anticipated relationships can then serve as quantitative indicators of potential tax avoidance schemes or even outright fraudulent activities, providing tax authorities with a more direct and effective approach to forensic tax analysis, particularly in economies with a significant underground sector.

V. STEM CEL: A Collaborative Framework for Enhanced Law Enforcement in Tax Administration

-

Conceptualizing the Integration of STEM Principles within Law Enforcement for Tax Investigations. In the contemporary landscape of law enforcement, the disciplines of science, technology, engineering, and mathematics (STEM) have become indispensable instruments in addressing the multifaceted challenges posed by crime, including the intricate realm of financial offenses such as tax evasion. STEM-focused training within law enforcement extends beyond traditional public safety frameworks, encompassing areas like computing and cybersecurity, which are increasingly relevant to understanding and combating financial crimes within the digital age. The collaborative synergy between law enforcement professionals and experts from STEM fields is crucial for developing innovative tools and methodologies that can effectively tackle the evolving tactics employed in financial fraud and tax evasion. Forensic accounting, a specialized branch that blends accounting principles with investigative techniques, stands as a powerful tool in the fight against financial crime, often serving as a critical asset for law enforcement agencies in their pursuit of illicit financial activities. These forensic accountants possess the unique ability to meticulously track down suspicious transactions and identify complex patterns in the movement of money, ultimately piecing together the puzzle of where things went wrong and who might be responsible for financial misconduct, including the deliberate evasion of tax obligations. The integration of STEM principles within law enforcement for tax investigations therefore involves not only equipping officers with foundational technical skills but also fostering robust collaborations with specialists from diverse STEM domains, such as data science for advanced financial analysis, forensic accounting for expert financial investigation, and engineering for the development of cutting-edge detection technologies.

-

Utilizing STEM Expertise to Enhance Data Analysis and Interpretation from CTAS and SAMS. The Federal Bureau of Investigation (FBI) recognizes the critical role of STEM expertise in its mission, offering specialized career paths for individuals with backgrounds in mathematics and data analysis within its Intelligence Community. These professionals are essential for conducting predictive and investigative analyses that help identify threats and understand security vulnerabilities. Furthermore, the FBI provides ongoing support and professional development for its data analysts and data scientists through the Data Analytics Support Hub (DASH) program, underscoring the agency’s commitment to leveraging data-driven insights. The field of data science offers a transformative approach to law enforcement, enabling agencies to analyze the vast troves of data at their disposal to enhance public safety, optimize the allocation of resources, and develop more effective strategies for preventing and solving crimes, including financial crimes. This involves the application of sophisticated techniques like machine learning and artificial intelligence algorithms to discern subtle patterns and anomalies that may indicate fraudulent or criminal activities within complex datasets. Forensic accountants operating within the IRS’s Criminal Investigation Division (CID) play a pivotal role in the detection of tax fraud by meticulously dissecting intricate financial data and utilizing specialized software and databases to gather, analyze, and interpret financial records and other pertinent information sources. Their expertise in financial investigation, combined with advanced analytical tools, allows them to identify discrepancies and patterns that may point towards tax evasion schemes and other illicit financial activities, ultimately supporting the efforts of law enforcement in ensuring compliance with tax laws.

-

Empowering Law Enforcement with Technological Tools for Proactive Identification of Potential UEA. Science and technology partnerships are proving to be instrumental in providing law enforcement agencies with innovative tools that significantly enhance their ability to combat crime, including the often-hidden activities within the underground economy. A prime example of this is the collaboration between the Department of Homeland Security’s (DHS) Science and Technology Directorate (S&T) and its partners, who have been at the forefront of rapidly developing, prototyping, testing, and deploying data-driven analytic tools specifically designed to support investigations into serious transnational crimes such as human trafficking, the illicit trafficking of fentanyl, and the exploitation of children. These cutting-edge tools empower law enforcement by enabling the automated discovery of high-value criminal targets and the identification of complex criminal associations that might otherwise remain undetected through traditional investigative methods. Recognizing the critical role of technology in staying ahead of evolving threats, the FBI actively develops and utilizes advanced technological solutions and scientific methodologies to identify criminal subjects, understand their underlying motives, and reconstruct the sequence of their activities leading up to and during the commission of a crime. STEM-skilled personnel are considered an integral part of the FBI’s workforce, embedded across all of its 56 field offices and Headquarters locations, highlighting the agency’s reliance on technical expertise. Furthermore, technology is playing an increasingly vital role in streamlining communication and enhancing operational effectiveness for law enforcement agencies at all levels. For instance, the integration of gun detection technologies directly with 911 dispatch centers can provide instant alerts to school officials and first responders during emergencies, while grid mapping services offer crucial navigational support, especially for officers unfamiliar with a particular campus or area. These technological advancements, often born from STEM collaborations, provide law enforcement with actionable intelligence that enables them to respond more quickly and effectively to potential threats and criminal activities, including those that may be indicative of underground economic activity.

VI. Deeply Digging into the Underground: Unveiling UEA through Integrated Tools

-

Employing the Tax Accounting Equation Framework within CTAS and SAMS to Flag Suspicious Activities. Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE) offers a novel and potentially powerful lens for detecting financial irregularities that may be indicative of Underground Economy Activity (UEA). By focusing on the equilibrium between a company’s revenue, expenses, assets, and liabilities, TAE can help uncover discrepancies that might suggest hidden or unreported economic activities. When this framework is applied to the vast amounts of taxpayer data stored within a Core Tax Administration System (CTAS), significant deviations from the expected relationships could serve as critical red flags, prompting further scrutiny and investigation by tax authorities. For instance, an entity reporting consistently low revenue but showing a substantial accumulation of assets over time might indicate the presence of undeclared income, a hallmark of UEA. Similarly, the fundamental accounting equation (Assets = Liabilities + Equity), when analyzed within the context of CTAS data, can reveal inconsistencies that point towards potential UEA. A taxpayer exhibiting a significant increase in assets without a corresponding increase in reported income (which would typically lead to an increase in equity through retained earnings) could be a strong indicator of income derived from the underground economy that has not been properly reported for tax purposes. Furthermore, the Self Assessment Monitoring System (SAMS), while primarily focused on systemic issues within tax administration, can play an indirect but valuable role in flagging suspicious activities related to UEA. SAMS can track patterns of complaints or observations reported by taxpayers or IRS employees that relate to specific industries, schemes, or geographical areas known to be susceptible to underground economic activity. This qualitative information, gathered through SAMS, can then be correlated with quantitative data extracted and analyzed from CTAS using the Tax Accounting Equation framework, providing a more comprehensive and targeted approach to identifying and investigating potential instances of UEA.

-

Leveraging STEM-Driven Data Analytics to Identify Patterns and Indicators of UEA. The application of STEM-driven data analytics to the extensive datasets held within a Core Tax Administration System (CTAS) offers a powerful means of identifying subtle patterns and indicators that may point towards Underground Economy Activity (UEA). Data mining techniques, for example, can be employed to uncover hidden correlations and anomalies within taxpayer financial data that might not be apparent through traditional methods of review. This could include identifying unusual spikes in specific types of expenses that are not logically supported by reported income, or detecting significant discrepancies between a taxpayer’s reported income and the average income for similar businesses within the same industry. Machine learning algorithms can be trained on historical data from known cases of UEA to recognize specific patterns and characteristics associated with such activity. These algorithms can then be applied to current CTAS data to identify taxpayers whose financial reporting exhibits similar patterns, allowing tax authorities to prioritize their audit efforts towards those with a higher likelihood of involvement in the underground economy. Furthermore, analyzing transaction data within CTAS can reveal characteristics commonly associated with UEA, such as a high volume of cash transactions relative to the size and nature of the business, or frequent transactions with individuals or entities that have a known history of involvement in illicit activities. Geospatial analysis, a valuable tool from the STEM field of geography, can also be applied to CTAS data to identify geographic areas that exhibit unusually low levels of reported income when compared to other indicators of economic activity within those regions. This can help authorities pinpoint potential hotspots of UEA and focus their investigative resources accordingly.

-

The Role of Forensic Accounting Techniques in Tracing Financial Flows in the Underground Economy. Forensic accounting techniques are indispensable for deeply investigating the often-concealed financial activities that characterize the Underground Economy Activity (UEA). By leveraging their specialized skills, forensic accountants can effectively “follow the money trail” within the vast datasets of a Core Tax Administration System (CTAS), meticulously tracing suspicious transactions and identifying the complex flow of funds that often underpins illicit economic activities. One powerful technique in the forensic accountant’s arsenal is the net worth method, which involves a detailed analysis of changes in an individual’s or entity’s assets and liabilities over a specific period. When applied using the comprehensive financial data available within CTAS, this method can effectively identify unexplained increases in wealth that are not consistent with reported income, serving as a strong indicator of potential income derived from UEA that has not been properly declared for tax purposes. Additionally, forensic accounting expertise is critical for conducting thorough financial statement analysis to detect red flags that are often associated with financial statement fraud, a practice frequently linked to tax evasion within the underground economy. By scrutinizing financial records for inconsistencies, unusual patterns, and deviations from expected norms, forensic accountants can uncover sophisticated methods employed to conceal income and evade tax obligations within the underground economy, providing invaluable insights for law enforcement and tax authorities.

VII. Advanced Methodologies and Technologies for Analyzing UEA

-

Applying Data Mining and Machine Learning Algorithms to Detect UEA Patterns. To further enhance the detection of Underground Economy Activity (UEA), advanced methodologies rooted in STEM fields, such as data mining and machine learning algorithms, can be effectively applied to the extensive datasets within a Core Tax Administration System (CTAS). Clustering algorithms, for instance, can be utilized to group taxpayers who exhibit similar patterns in their financial statements, allowing tax authorities to identify clusters of individuals or businesses whose reporting behavior deviates significantly from the norm and may therefore warrant closer scrutiny for potential involvement in UEA. These algorithms can uncover subtle similarities in financial reporting that might be indicative of participation in the same underground economic networks or the use of similar tax evasion strategies. Furthermore, machine learning models can be trained using historical audit data from past cases of tax fraud and UEA. By learning from these labeled datasets, the models can then be applied to current CTAS data to predict the likelihood of tax fraud and UEA based on a taxpayer’s financial statement characteristics, transaction patterns, and other relevant indicators. This predictive capability can significantly improve the efficiency of audit selection processes, allowing tax authorities to focus their limited resources on the cases with the highest potential for uncovering illicit activity. Additionally, anomaly detection algorithms, a subset of machine learning, can be employed to identify unusual or outlier financial activities within CTAS that do not conform to expected patterns. These anomalies, such as unusually large or frequent transactions with no clear business purpose, or significant deviations in financial ratios compared to industry averages, can serve as valuable leads for further investigation into potential UEA.

-

The Potential of Artificial Intelligence in Identifying and Predicting Underground Economic Activities. Artificial intelligence (AI) holds tremendous potential for transforming the way tax authorities identify and predict Underground Economy Activity (UEA) by leveraging its ability to automate complex tasks, analyze vast amounts of data, and detect subtle patterns indicative of illicit behavior. AI-powered tools can be integrated into tax administration systems like CTAS to automate the often-laborious processes of data collection, cleaning, and analysis, significantly enhancing the efficiency of identifying potential UEA in real-time. These systems can be trained to continuously monitor taxpayer data for anomalies, inconsistencies, and deviations from established norms that might suggest involvement in the underground economy. Furthermore, AI can play a crucial role in risk assessment by analyzing a multitude of data points, including financial history, transaction patterns, and even publicly available information, to identify taxpayers or industries that exhibit a higher propensity for engaging in UEA. This allows tax authorities to proactively focus their compliance efforts and investigative resources on the areas where they are likely to have the greatest impact. Predictive analytics, a powerful application of AI, can also be utilized to forecast potential areas of UEA by analyzing historical trends, economic indicators, and other relevant factors. This foresight enables tax authorities and law enforcement agencies to anticipate emerging threats within the underground economy and allocate their resources proactively to prevent or disrupt illicit activities before they escalate. By automating many of the time-consuming and complex processes involved in UEA detection and prediction, AI empowers tax administrations to operate more efficiently, make more informed decisions, and ultimately enhance their effectiveness in combating the underground economy.

-

Exploring the Use of Network Analysis to Uncover Connections within the Underground Economy. Network analysis offers a valuable and increasingly important methodology for uncovering the often-hidden connections and organizational structures that characterize the Underground Economy Activity (UEA). By applying network analysis techniques to the extensive data contained within a Core Tax Administration System (CTAS), tax authorities and law enforcement agencies can map and visualize the intricate relationships between various individuals, businesses, and financial transactions. This approach allows for the identification of potential hidden networks and the elucidation of how different actors within the underground economy are connected and interact with one another. For instance, network analysis can reveal previously unknown associations between individuals or businesses that might appear unrelated on the surface but are in fact engaged in coordinated illicit activities. Identifying central nodes or key players within these UEA networks is crucial, as it allows law enforcement and tax authorities to strategically target the most influential actors and disrupt the flow of illegal goods, services, and funds more effectively. By focusing on these central figures and their connections, authorities can potentially dismantle entire underground economic operations rather than just addressing isolated instances of non-compliance. Furthermore, the insights gained from network analysis can be significantly enhanced by combining it with other STEM-driven techniques, such as social network analysis to understand the social dynamics within UEA groups and link prediction algorithms to anticipate the formation of new connections or the emergence of previously unknown actors. This holistic approach provides a more comprehensive and nuanced understanding of the organization, operation, and evolution of the underground economy, ultimately leading to more targeted and effective strategies for its disruption and mitigation.

VIII. Challenges, Considerations, and Recommendations for Implementation

-

Addressing Data Security, Privacy, and Ethical Implications of Integrated Systems. The integration of sensitive data from law enforcement agencies, tax administration systems (CTAS and SAMS), and potentially other governmental databases presents significant challenges related to data security and the fundamental privacy rights of individuals and businesses. The sheer volume and highly confidential nature of financial and personal information necessitate the implementation of robust and multi-layered security protocols to safeguard against unauthorized access, data breaches, and potential misuse. These protocols must include state-of-the-art encryption techniques, sophisticated firewall systems, stringent access control mechanisms, and regular security audits to ensure the ongoing integrity and confidentiality of the data. Furthermore, the establishment of clear legal frameworks and comprehensive regulations is absolutely crucial to govern the collection, storage, use, and sharing of data across different governmental agencies involved in UEA investigations. These frameworks must explicitly define the permissible purposes for data access, the procedures for data handling, and the consequences for any violations of privacy laws. The increasing reliance on advanced technologies like artificial intelligence (AI) and facial recognition for identifying and predicting UEA also raises significant ethical considerations that must be carefully addressed to prevent potential biases, discriminatory outcomes, and unwarranted infringements on civil liberties. Transparency in how these technologies are developed, deployed, and utilized is paramount, along with the establishment of independent oversight mechanisms to ensure accountability and prevent any misuse of these powerful tools. The benefits of integrating systems and leveraging advanced technologies for combating UEA must therefore be carefully balanced against the critical imperative of protecting individual privacy, ensuring the security of sensitive data, and adhering to the highest ethical standards to maintain public trust and uphold the rule of law.

-

Ensuring Effective Collaboration and Information Sharing Between Law Enforcement and Tax Authorities. The effective investigation and mitigation of Underground Economy Activity (UEA) hinges on the establishment of clear, formal protocols and secure mechanisms that facilitate seamless and responsible information sharing between law enforcement agencies (such as the FBI, ATF, and ICE) and tax authorities (like the IRS). This includes the development of standardized data formats and secure communication channels that allow for the timely and efficient exchange of relevant information while adhering to legal and privacy requirements. Furthermore, the development and implementation of joint training programs for personnel from both law enforcement and tax administration agencies are essential to foster a shared understanding of each other’s respective mandates, operational procedures, and specialized expertise in combating financial crimes and UEA. These training initiatives can help bridge potential cultural and operational gaps between the agencies, promoting more effective collaboration and a unified approach to investigations. Creating and actively supporting interdisciplinary task forces that bring together experts from various fields, including law enforcement, tax administration, data science, forensic accounting, and relevant STEM disciplines, can significantly enhance the effectiveness of UEA investigations. These task forces provide a platform for the pooling of diverse skills, knowledge, and resources, allowing for a more comprehensive and targeted approach to tackling the complex and multifaceted nature of the underground economy. Ultimately, fostering a culture of trust and cooperation between these agencies is paramount to maximizing the impact of integrated tools and the collective expertise in the fight against UEA.

-

Developing Training and Expertise in Interdisciplinary Approaches for UEA Investigation. To effectively combat the multifaceted nature of Underground Economy Activity (UEA), it is crucial to invest in the development of a workforce that possesses a diverse skillset spanning law enforcement, tax administration, and various STEM fields. This requires the implementation of targeted training programs that equip law enforcement personnel with a foundational understanding of key tax laws, accounting principles, and financial analysis techniques that are relevant to UEA investigations. Similarly, tax administration staff should receive comprehensive training on law enforcement investigative methodologies, digital forensics techniques for tracing online financial activities, and data analysis methodologies for identifying patterns of illicit economic behavior. Furthermore, there should be a concerted effort to encourage and support the development of interdisciplinary academic programs within universities that combine fields such as criminology, economics, data science, and accounting, with a specific focus on financial crime and tax evasion. These programs can help cultivate a new generation of professionals who possess the integrated knowledge and skills necessary to tackle the complexities of UEA. Moreover, promoting continuous professional development opportunities for both law enforcement and tax administration professionals is essential to ensure that their skills and knowledge remain current in the rapidly evolving landscape of technology, financial crime, and the sophisticated tactics employed within the underground economy. This can be achieved through workshops, specialized conferences, online learning platforms, and collaborations with academic institutions and industry experts. By investing in the training and education of professionals across these diverse disciplines, government agencies can build a highly skilled workforce that is well-equipped to effectively utilize an integrated approach in the ongoing fight against UEA.

-

Policy Recommendations to Support the Integration of STEM, Law Enforcement, and Tax Administration for UEA Detection. To effectively support the integration of STEM principles, law enforcement practices, and tax administration frameworks in the ongoing effort to detect and combat Underground Economy Activity (UEA), several key policy recommendations should be considered by government agencies and policymakers. Firstly, there is a critical need to enact clear and comprehensive legislation that explicitly authorizes and facilitates the secure and responsible sharing of relevant data between law enforcement agencies and tax authorities for the specific purpose of investigating UEA, while ensuring that robust safeguards are in place to protect individual privacy rights and prevent any misuse of sensitive information. Secondly, sustained and dedicated funding should be allocated at the federal, state, and local levels for the development, implementation, and maintenance of integrated technology platforms and advanced analytical tools, including sophisticated artificial intelligence (AI) and machine learning capabilities, to support the detection, analysis, and prediction of UEA. Thirdly, the development of comprehensive national strategies and clear guidelines for combating the underground economy is essential. These strategies should explicitly promote and support the integration of STEM principles, law enforcement practices, and tax administration frameworks, and should include the establishment of measurable goals, performance indicators, and mechanisms for interagency coordination and collaboration. Fourthly, policies should be implemented to create incentives and formalize mechanisms for fostering ongoing collaboration and the formation of dedicated joint task forces between law enforcement and tax authorities at various levels of government, specifically focused on the investigation and prosecution of UEA. Finally, it is crucial to establish clear legal frameworks and ethical guidelines that govern the development and use of advanced technologies like AI and data analytics in UEA investigations, ensuring transparency, accountability, and adherence to principles of fairness and due process. By implementing these policy recommendations, governments can create an enabling environment that empowers agencies to fully leverage an integrated approach in the fight against the underground economy.

IX. Conclusion: Towards a Data-Driven Approach to Combating the Underground Economy

The integration of STEM principles within law enforcement, coupled with the analytical power of the Tax Accounting Equation framework and the data management capabilities of CTAS and SAMS, presents a significant opportunity to enhance the investigation and mitigation of Underground Economy Activity. This integrated approach, which we term “STEM CEL,” empowers law enforcement with data-driven insights, advanced technological tools, and a deeper understanding of financial irregularities indicative of UEA. By fostering interdisciplinary collaboration between STEM experts, law enforcement professionals, and tax administrators, government agencies can move towards a more proactive and effective strategy for combating the underground economy. The application of advanced methodologies like data mining, machine learning, artificial intelligence, and network analysis to the vast datasets within tax administration systems holds the key to uncovering complex patterns and hidden connections that characterize illicit economic activities. However, the successful implementation of such an integrated framework necessitates careful consideration of data security, privacy rights, and ethical implications, along with the establishment of clear legal frameworks and robust policies that support interagency collaboration and the development of specialized expertise. As the underground economy continues to evolve and adapt, it is imperative that government agencies embrace a data-driven and technologically advanced approach, underpinned by strong interdisciplinary collaboration, to effectively address this persistent challenge and safeguard the fiscal integrity of the nation.

Reporter: Marshanda Gita – Pertapsi Muda