The Triple Power of Integration: A Strategic Blueprint for Indonesia’s Enhanced Tax Revenue and Administration

Executive Summary

Indonesia, facing a persistent low tax-to-GDP ratio, has embarked on an ambitious digital transformation of its tax administration. This initiative, termed the “Triple Power of Integration,” represents a fundamental shift in the nation’s approach to taxation. It synergistically combines the Core Tax Administration System (CTAS), the Tax Accounting Equation (TAE), the Self-Assessment Monitoring System (SAMS), and a modern Triple Entry Accounting System (TEAS). This holistic framework aims to transition from traditional reactive tax enforcement to a proactive, data-driven compliance ecosystem, ultimately boosting tax deposits and increasing the national tax ratio.

The integration promises substantial advantages, including heightened accuracy in tax calculations, continuous compliance oversight, unified administrative processes, and the establishment of immutable financial data records. These collective benefits are designed to significantly enhance tax collection efficiency and foster a stronger culture of voluntary compliance. However, the successful realization of this transformative vision is contingent upon effectively navigating considerable challenges. These include ensuring the readiness of digital infrastructure, achieving seamless data interoperability, harmonizing regulatory frameworks, developing requisite human capital, and establishing robust data security measures to maintain public trust.

To address these complexities and ensure the initiative’s success, strategic recommendations are imperative. These include a meticulously planned phased implementation, targeted investments in digital infrastructure, comprehensive training programs for both tax officials and taxpayers, the adoption of agile regulatory frameworks that can adapt to technological advancements, and sustained, transparent engagement with all stakeholders.

1. Introduction : The Imperative for Tax Modernization in Indonesia

Indonesia’s economic aspirations are significantly tied to its ability to mobilize domestic resources. A critical indicator of this capacity is the tax-to-GDP ratio, which stood at a modest 12% in 2022. This figure lags behind global standards and presents a substantial impediment to the nation’s ability to finance essential public services, infrastructure development, and key social programs. The consistent underperformance in tax collection underscores an urgent need for comprehensive tax reform to bolster state revenue and achieve greater fiscal sustainability. The low tax-to-GDP ratio is not merely a statistical concern; it represents a fundamental constraint on Indonesia’s long-term development objectives, including its ambitious goal of becoming a high-income economy by 2045. This elevates the “Triple Power of Integration” initiative from a mere administrative upgrade to a national strategic imperative, directly impacting the nation’s future prosperity.

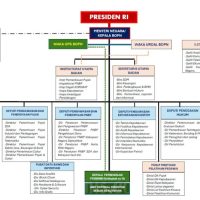

The Directorate General of Taxes (DGT), operating under the Ministry of Finance, bears the crucial responsibility for formulating tax policies, ensuring compliance, and managing the nation’s revenue collection system. Recognizing the limitations of outdated manual processes and the imperative for modernization, the DGT has embarked on a profound digital transformation. Their strategic blueprint emphasizes a comprehensive overhaul of IT infrastructure, data management, and digital services. This transformation involves leveraging advanced analytical capabilities, including big data analytics, artificial intelligence (AI), and machine learning (ML), to derive deeper insights, detect fraud, and conduct more precise risk assessments. The DGT’s digital transformation is not simply about adopting new technological tools; it signifies a fundamental redesign of their core business processes and a significant shift in organizational culture. This comprehensive approach acknowledges that technology alone is insufficient without accompanying structural and human capital reforms, aiming for a more integrated, effective, and efficient tax administration.

At the heart of Indonesia’s modernized tax administration lies the “Triple Power” framework. This ambitious initiative encompasses four interconnected components: the Core Tax Administration System (CTAS), the Tax Accounting Equation (TAE), the Self-Assessment Monitoring System (SAMS), and a modern Triple Entry Accounting System (TEAS). This integrated framework represents a significant leap towards a more modern, data-driven, and proactive tax administration system in Indonesia. Its overarching design is to minimize tax evasion, significantly enhance compliance, and ultimately contribute to a higher tax ratio and increased tax deposits for the nation.

2. Core Tax Administration System (CTAS) : The Digital Backbone

The Core Tax Administration System (CTAS), widely known as Coretax, stands as the foundational pillar of Indonesia’s digital transformation in tax administration. This pivotal system officially became effective on January 1, 2025, underpinned by Regulation No. 81 of 2024 (PMK-81). A significant aspect of PMK-81 is its comprehensive nature, as it revokes 42 existing regulations to streamline and harmonize the legal framework governing tax administration. This deliberate and comprehensive effort to consolidate and simplify the regulatory environment is crucial for the successful implementation of such a complex IT system. By proactively aligning the legal framework, potential ambiguities that could hinder operational efficiency are mitigated, paving the way for smoother adoption and greater effectiveness of the new digital platform. The CTAS initiative is an integral part of the broader Tax Administration System Renewal Project (PSIAP), which was formally mandated by Presidential Regulation No. 40 of 2018.

CTAS is meticulously designed to streamline all core tax administration processes, integrating disparate data sources into a cohesive and unified system. These critical processes include taxpayer registration, the filing of tax returns, efficient payment processing, continuous compliance tracking, and robust auditing functions. Key features of the new system encompass online tax reporting and payment capabilities, the establishment of a real-time taxpayer database, automated compliance checks, enhanced data security protocols, and seamless integration with key external entities such as banks and other financial institutions. The system’s primary objective is to replace outdated manual procedures, thereby significantly reducing human errors and enhancing the real-time monitoring of tax data. The shift to a “real-time taxpayer database” and “automated compliance checks” represents a fundamental transformation towards continuous transaction control or near-real-time tax reporting. This capability significantly enhances the DGT’s ability to identify instances of non-compliance much earlier in the tax cycle, often as transactions occur or shortly after. This proactive capability, a cornerstone enabled by CTAS, is a foundational element for the “Triple Power” to truly achieve its intended impact, allowing for timely interventions rather than relying solely on post-reporting audits.

Since its launch, CTAS has demonstrated significant initial progress. As of January 12, 2025, the system recorded 159,735 taxpayers with authorization codes for invoice signatures, and over 1.5 million tax invoices had been successfully created. Despite these early successes, the transition has not been without its temporary challenges. Reported issues include difficulties with system accessibility, authorization processes, data matching (such as the synchronization of National Identity Numbers, NIK, with Taxpayer Identification Numbers, NPWP), and the updating of management data. The Directorate General of Taxes has acknowledged these “kinks” and is actively engaged in resolving them. The challenges encountered during the CTAS rollout, particularly those related to data matching (NIK-NPWP) and digital certificates, underscore the inherent complexity of integrating a new, large-scale system with existing national identity and business registration frameworks. This situation highlights that successful digital transformation is not merely a technological deployment but also a significant undertaking in change management and data governance. It requires meticulous attention to data accuracy, interoperability across various government systems, and comprehensive user adoption strategies, reflecting the broader complexities often associated with large-scale government IT projects.

3. The Tax Accounting Equation (TAE) : Precision in Tax Liability Assessment

The Tax Accounting Equation (TAE) is an innovative tool developed by Indonesian tax specialist Dr. Joko Ismuhadi, specifically designed for advanced tax analysis. It represents a pioneering adaptation of the fundamental accounting equation (Assets = Liabilities + Equity) to the unique context of Indonesian tax analysis. TAE is presented in two interrelated formulations: Revenue - Expenses = Assets - Liabilities and Revenue = Expenses + Assets - Liabilities. These formulations are strategically designed to place a deliberate emphasis on revenue, recognizing it as a critical indicator of a company’s economic activity and its corresponding tax obligations. Furthermore, to address specific scenarios where taxable income might be intentionally reported as zero or negative to minimize tax liabilities, Dr. Ismuhadi also formulated the Mathematical Accounting Equation (MAE) as: Assets + Dividen + Beban = Kewajiban + Ekuitas + Pendapatan. TAE’s profound emphasis on revenue and its direct linkage to balance sheet components directly addresses a prevalent tax evasion tactic: the underreporting of income. By providing a mathematical framework that establishes an “expected equilibrium” between key financial reporting components and a company’s tax obligations, TAE transcends traditional auditing’s reliance on mere transaction-level checks. Instead, it enables a more holistic, forensic analysis of financial statements, allowing tax authorities to identify inconsistencies that may indicate intentional misreporting.

One of TAE’s most significant benefits is its capacity for the early detection of potential tax avoidance schemes. By analyzing the financial statements of taxpayers through the lens of TAE, tax officials can pinpoint inconsistencies that suggest intentional misreporting of revenue or expenses. This quantitative assessment framework allows significant deviations from anticipated relationships to serve as clear indicators of potential tax avoidance or even fraudulent activities. The “early detection” capability of TAE fundamentally transforms the DGT’s operational model. It shifts the focus from ex-post audit findings, which typically involve extensive and time-consuming investigations of past activities, to ex-ante risk flagging. This proactive identification of potential irregularities, either before or shortly after self-assessment submission, significantly reduces the time and cost associated with traditional audits. More importantly, it substantially increases the likelihood of recovering underpaid taxes by enabling timely interventions, thereby minimizing the “tax gap”.

A crucial aspect of TAE’s efficacy is its specific design for the Indonesian economic environment. Developed by an Indonesian tax expert, TAE explicitly accounts for the unique challenges and characteristics prevalent in the country, including the widespread presence of the underground economy and various common tax evasion tactics. By identifying discrepancies between reported financial data and expected tax obligations, TAE can provide invaluable insights into the scale and nature of the underground economy. This contextualization makes TAE a potentially more effective tool than generic accounting analytics, as it is tailored to target specific local challenges and evasion patterns, offering a pragmatic approach to addressing a pervasive issue in developing economies.

4. Self-Assessment Monitoring System (SAMS) : Proactive Compliance and Risk Intelligence

The Self-Assessment Monitoring System (SAMS) is meticulously designed to oversee and analyze taxpayers’ self-declared tax obligations, representing a pivotal shift towards proactive compliance. This system leverages detailed financial data, particularly that derived from a triple-entry accounting system, and integrates advanced analytical capabilities, including Artificial Intelligence (AI) and Machine Learning (ML), to identify trends, risks, and potential discrepancies in taxpayer reporting. SAMS is a key component of the broader STEM CEL (Science, Technology, Engineering, and Mathematics with Collaboration for Empowering Law-enforcement) module, which aims to significantly enhance the overall capabilities of the tax administration system. The incorporation of AI/ML within SAMS signifies a strategic evolution beyond conventional rule-based compliance checks. These advanced technologies enable predictive analytics and sophisticated anomaly detection, allowing the DGT to anticipate non-compliance and uncover intricate evasion schemes that might otherwise elude traditional detection methods. This capability directly contributes to the DGT’s goal of developing “smarter tax policies” by providing a more intelligent and adaptive monitoring framework.

SAMS operates as a dynamic and proactive benchmark, continuously monitoring data consistency and highlighting deviations that warrant further scrutiny. Upon identifying such discrepancies, the system can automatically generate alerts and notifications for tax officials, facilitating timely follow-up and investigation. A critical feature of SAMS is its ability to integrate with other government databases, such as bank records or property ownership details. This cross-referencing capability allows SAMS to validate taxpayer information against diverse external sources, triggering alerts for inconsistencies that might indicate undeclared income or assets. This comprehensive data integration is a crucial multiplier effect, directly addressing challenges related to “data quality and interoperability” by providing a more holistic view of a taxpayer’s financial activities beyond their self-declared tax data. Furthermore, sophisticated risk scoring mechanisms within SAMS can assign compliance risk scores to taxpayers, based on a variety of factors including their past compliance history, prevailing industry trends, and deviations from expected financial norms.

The synergistic integration of the Tax Accounting Equation (TAE) within SAMS is fundamental to the system’s power. TAE significantly enhances the accuracy and consistency of tax calculations by serving as an active benchmark within SAMS, continuously monitoring data consistency and highlighting critical deviations. This powerful combination allows organizations to establish a data-driven internal mechanism for identifying potential tax irregularities, thereby ensuring the accuracy of financial data and fostering a stronger culture of compliance. The fusion of TAE’s forensic analytical power with SAMS’s continuous monitoring capabilities creates a dynamic feedback loop. The system continuously learns and adapts, making it more resilient to evolving evasion tactics and enabling a truly “proactive” compliance stance [User Query]. TAE provides SAMS with the mathematical intelligence to discern what to look for in the vast datasets, while SAMS provides the robust platform for TAE to be applied at scale and in real-time.

The operational outputs of SAMS are designed to translate complex data analytics into actionable intelligence for tax officials. These outputs include the generation of alerts and notifications, as well as the provision of visual dashboards that display key financial metrics derived from TAE. These dashboards offer an at-a-glance overview of a taxpayer’s financial health and potential tax compliance risks. The implementation of “visual dashboards” and “risk scoring mechanisms” is crucial for effective decision-making and the efficient allocation of the DGT’s limited audit and enforcement resources. This approach moves beyond presenting raw data, instead providing prioritized actions, thereby addressing the “last-mile problem” for DGT personnel by enabling them to quickly understand and act on the system’s findings without requiring specialized data science expertise.

The following table illustrates how SAMS, powered by TAE and AI/ML, identifies and categorizes various compliance risks, demonstrating the system’s proactive capabilities:

Table 1: SAMS Risk Identification Framework

| Risk Category | TAE/SAMS Mechanism | Data Sources | System Output | Impact on Compliance |

|---|---|---|---|---|

| Under-reporting | Deviation from TAE equilibrium, AI/ML anomaly detection | Triple-Entry Ledger, CTAS data, e-Faktur | High-risk score, Alert to tax official | Early intervention, Reduced tax gap, Increased deposits |

| Inconsistency | Cross-referencing external databases, Data matching | Triple-Entry Ledger, CTAS data, Bank records, Property ownership, e-Faktur | Flag for audit, Discrepancy report | Enhanced data accuracy, Proactive correction |

| Fraud Indicators | AI/ML pattern recognition, Trend analysis | Triple-Entry Ledger, CTAS data, e-Faktur, External data | High-risk score, Fraud alert | Targeted investigations, Prevention of evasion |

| Non-filing/Late Payment | Automated compliance checks, Real-time monitoring | CTAS taxpayer database, Payment records | Automated reminder, Penalty trigger | Improved compliance rates, Timely revenue collection |

| Undeclared Economic Activity | Discrepancies between reported and external data, Predictive analytics | Triple-Entry Ledger, External data (e.g., e-commerce platforms) | Anomaly flag, Investigative lead | Expansion of tax base, Reduction of underground economy |

5. Triple Entry Accounting System (TEAS) : The Bedrock of Trust and Immutability

The evolution of accounting records has reached a significant inflection point with the advent of blockchain technology, giving rise to the modern concept of Triple Entry Accounting Systems (TEAS). Moving beyond the traditional double-entry system, TEAS adds a third, immutable entry to financial transactions, which is recorded on a distributed ledger. The foundational concept of a third entry was introduced by accounting scholar Yuji Ijiri in 1986, who proposed a “trebit” entry to explain changes in income. Blockchain technology effectively fulfills the requirement of this trusted, third-party maintained shared ledger, offering inherent features of decentralization, immutability, and secure recording of transactions. Blockchain-based triple entry accounting fundamentally redefines the concept of trust in financial reporting. By embedding transactions on an immutable, shared ledger, it shifts from a system reliant on auditor verification of potentially alterable records to one where data integrity is inherent and verifiable by all parties. This drastically reduces information asymmetry between transacting parties and with tax authorities.

The core features of TEAS, particularly when underpinned by blockchain, include enhanced transparency, robust security, and comprehensive traceability. Once transactions are recorded on the blockchain, they cannot be altered, thereby ensuring unparalleled data integrity. This cryptographic protection acts as a formidable safeguard against fraud and tampering. Furthermore, all participants in the distributed ledger network have access to the same immutable data, fostering a high degree of trust and accountability across the ecosystem. The immutability and transparency provided by blockchain have direct and profound implications for reducing the “tax gap”—the difference between the theoretical tax revenue and the amount actually collected. By rendering financial data verifiable and highly resistant to manipulation, TEAS proactively closes traditional avenues for tax evasion. This moves the system beyond mere detection to the prevention of certain types of fraud, such as the alteration of past records, thereby directly contributing to increased tax deposits.

These features yield significant benefits for tax administration. The heightened integrity of financial data forms a verifiable bedrock for more accurate tax assessments and effective monitoring. TEAS also streamlines auditing processes by simplifying audit trails and substantially reducing the time and resources traditionally spent on reconciliations. Moreover, the integration of smart contracts within a blockchain-based TEAS allows for the automation of tax calculations and reporting based on predefined rules, minimizing errors and ensuring consistent compliance. The ability to automate tax calculations and reporting via smart contracts represents a significant leap towards “built-in compliance”. This transforms tax administration from a periodic reporting and auditing cycle to a continuous, real-time compliance mechanism. This automation can drastically reduce administrative burdens for both taxpayers and the DGT, aligning with the OECD’s “Tax Administration 3.0” vision of making tax administration more “seamless and frictionless”.

It is crucial to clarify the distinction between this modern, blockchain-based triple-entry accounting and the traditional use of “triple entry” in Indonesian regional government accounting. The latter refers to entries made into budget books and does not involve a distributed ledger. This traditional method is essentially a double-entry system for cash transactions recorded within budget books. This clarification is vital to prevent misinterpretation and to underscore the profound technological leap being proposed. The modern TEAS is not a mere procedural adjustment; it represents a fundamental paradigm shift in data architecture and the underlying trust mechanism.

Indonesia possesses substantial potential to implement blockchain-based triple entry accounting to enhance transparency, significantly reduce fraud, and improve overall tax administration efficiency. Research has already explored blockchain-based approaches for secure and transparent e-Faktur (electronic tax invoice) issuance within Indonesia’s VAT reporting system. These initiatives leverage private permissioned blockchains, such as Hyperledger Fabric, to address the challenges associated with issuing and verifying tax invoices. This approach reduces reliance on centralized servers, eliminates single points of failure, and significantly enhances auditability. The focus on e-Faktur issuance as a specific application of blockchain in Indonesia is highly strategic, as e-Faktur data is a crucial internal data source for diagnostic and predictive analytics in tax compliance supervision. By securing and making this foundational data immutable at its source, it significantly enhances the reliability and trustworthiness of all subsequent compliance monitoring and risk assessment processes within SAMS and CTAS.

The following table provides a comparative analysis of different accounting systems, highlighting the transformative advantages of blockchain-based Triple Entry Accounting for tax administration:

Table 2: Comparative Analysis of Accounting Systems for Tax Administration

| Feature | Double-Entry Accounting | Traditional Triple-Entry (Indonesia) | Blockchain-based Triple-Entry |

|---|---|---|---|

| Number of Entries | Two (Debit/Credit) | Two (Cash transactions) | Three (Debit/Credit/Immutable Third) |

| Ledger Type | Internal | Budget Book | Distributed Ledger |

| Immutability | Low (records can be altered) | Low (records can be altered) | High (cryptographically secured) |

| Transparency | Internal | Limited (to budget stakeholders) | High (shared across network) |

| Fraud Resistance | Vulnerable to manipulation | Vulnerable to manipulation | High (tamper-proof) |

| Audit Process | Manual/Periodic, Reconciliation-heavy | Manual/Budget-focused | Streamlined/Continuous, Real-time verification |

| Trust Mechanism | Auditor/Internal Control | Internal Control/Budget Rules | Cryptographic/Consensus, Network-based |

| Applicability in Tax Admin | Foundational for financial reporting | Specific to government budgeting | Transformative, Real-time compliance & enforcement |

6. The “Triple Power” in Action : Boosting Tax Deposits and Ratio

The integration of the Tax Accounting Equation (TAE), the Self-Assessment Monitoring System (SAMS), and the Triple Entry Accounting System (TEAS) within the Core Tax Administration System (CTAS) creates a formidable “Triple Power” framework designed to significantly boost tax deposits and increase Indonesia’s tax ratio. This section details how this integrated system functions to achieve higher tax revenue.

Early Detection of Under-reporting

The synergistic combination of TAE’s forensic analytical power and SAMS’s continuous monitoring capabilities, all operating within the CTAS environment, allows for the automated and proactive identification of potential tax under-reporting. TAE provides the mathematical framework necessary to detect inconsistencies between reported financial data, sourced reliably from the TEAS, and expected tax obligations. SAMS, leveraging advanced AI/ML algorithms, then flags these anomalies and generates immediate alerts for DGT intervention. This capability enables the DGT to intervene much earlier in the tax cycle, prompting taxpayers to rectify their declarations and deposit the correct amount of tax, thereby effectively minimizing the “tax gap”. This “early detection” mechanism fundamentally shifts the DGT’s operational model from detecting and penalizing historical non-compliance to preventing and correcting real-time discrepancies. This proactive stance not only facilitates the faster recovery of lost revenue but also cultivates a culture of immediate compliance, as taxpayers become acutely aware of the system’s continuous monitoring capabilities and the increased likelihood of prompt detection.

Enhanced Voluntary Compliance

With a transparent and verifiable triple-entry accounting system (TEAS), coupled with the intelligent and continuous monitoring provided by TAE and SAMS, taxpayers are significantly more likely to comply voluntarily with their tax obligations [User Query]. The heightened integrity of financial data, which is inherently resistant to manipulation due to the immutability of blockchain-recorded transactions, drastically reduces opportunities for evasion. This increased visibility and the reduced scope for illicit activities create a stronger deterrent effect, actively encouraging taxpayers to accurately self-assess and report their liabilities. The enhanced transparency fostered by TEAS , combined with the proactive monitoring capabilities of SAMS, creates a “slippery slope” framework for tax compliance. When taxpayers perceive a higher likelihood of detection due to the system’s continuous oversight and the immutability of their financial records, it strengthens the “power” dimension of the tax authority. This increased perception of enforcement effectiveness, in turn, fosters greater trust in the tax system over time, leading to a sustained increase in voluntary compliance.

Targeted Enforcement

The sophisticated risk identification capabilities of SAMS, powered by TAE’s analytical insights and seamlessly integrated into CTAS, enable the DGT to precisely focus its audit and enforcement efforts on high-risk taxpayers. This data-driven approach ensures a more targeted and efficient allocation of scarce audit resources, moving away from broad, less effective audits to pinpointed interventions. “Targeted enforcement” enabled by advanced analytics is critically important for maximizing revenue collection, especially in a resource-constrained environment. By accurately identifying the highest-value non-compliance cases, the DGT can achieve a substantially higher return on investment for its enforcement activities. This direct efficiency gain in enforcement efforts directly contributes to an increase in both tax deposits and the overall tax ratio.

Reduced Administrative Costs

The streamlined processes inherent within CTAS, combined with the automated monitoring capabilities of SAMS and the robust data integration facilitated by TEAS, can significantly reduce the administrative burden on the DGT. Automation minimizes manual processes, which in turn reduces errors and accelerates workflows across the entire tax administration. This operational efficiency allows valuable DGT resources to be reallocated from routine, low-value tasks to higher-value activities, such as strategic tax policy development, complex investigations, or enhanced taxpayer services. The reduction in administrative costs extends beyond mere financial savings; it fundamentally optimizes the DGT’s human capital. By automating repetitive and time-consuming tasks, the system frees up tax professionals to concentrate on more strategic, analytical, and taxpayer-centric roles. This qualitative improvement in human resource utilization ultimately enhances the overall quality and efficiency of tax administration.

Improved Data Integrity

A triple-entry accounting system, particularly when leveraging blockchain technology, ensures that the financial data used for tax calculations is inherently more reliable and trustworthy. The immutability and transparency of blockchain-recorded transactions provide a verifiable and unalterable bedrock for highly accurate tax assessments. This enhanced data integrity is crucial for building a tax system that is both efficient and equitable, as it minimizes disputes arising from data discrepancies and strengthens the foundation for all subsequent tax administration processes.

7. Challenges and Critical Success Factors for Implementation

While the “Triple Power of Integration” offers transformative potential for Indonesia’s tax administration, its successful implementation is contingent upon effectively addressing several significant challenges.

Technological and Infrastructure Readiness

A primary challenge lies in the readiness of Indonesia’s digital infrastructure, particularly in rural and remote areas where access to reliable internet and mobile payment systems remains limited. This uneven distribution of technological infrastructure can exacerbate inequities in tax implementation and hinder widespread adoption of the new digital systems. Furthermore, the increasing reliance on digital platforms like CTAS and SAMS necessitates the implementation of robust cybersecurity measures and the development of sophisticated digital forensics capabilities to protect sensitive taxpayer data from cyber threats and unauthorized access. Investing in these foundational elements is crucial for the system’s resilience and public trust.

Data Quality, Interoperability, and Governance

The effectiveness of an integrated system heavily relies on the quality and interoperability of data from various sources. Tax officers frequently encounter a “last-mile problem,” where centrally provided data is not immediately actionable, requiring them to develop their own data pipelines for further processing. This can lead to inconsistencies and conflicts with organizational data governance policies. Significant challenges persist in integrating data seamlessly between various sectors and related institutions. Ensuring comprehensive data sharing and addressing issues of data accuracy and consistency across disparate government and private sector databases are paramount for the system’s analytical capabilities to reach their full potential.

Regulatory Harmonization and Legal Certainty

The rapid evolution of the digital economy necessitates a corresponding modernization of tax regulations. Challenges include legal uncertainties regarding the identification of micro, small, and medium businesses in digital transactions, the status of digital economy subjects, and the traditional concept of “permanent establishment” which often relies on physical presence. These ambiguities can significantly reduce taxpayer compliance and hinder effective tax enforcement. Comprehensive policies are needed to ensure the integration of regulations between institutions. The implementation of a modern VAT system, for instance, requires improved data integration and clear regulatory standards to support new mechanisms like real-time digital compensation for low-income households.

Human Capital Development and Tax Literacy

The successful adoption of advanced tax technologies requires a highly skilled workforce within the DGT and a digitally literate taxpayer base. There is a recognized need for skilled AI personnel in the public sector. Comprehensive training programs are essential to prepare DGT employees as users of the new system, enabling them to manage and monitor the increasing number of taxpayers effectively. Simultaneously, the level of tax literacy among the general public remains a challenge, with misunderstandings of digital tax procedures and distrust of new systems potentially hindering implementation. Bridging this digital literacy gap and ensuring accessible channels for taxpayer support are critical for fostering widespread adoption and compliance.

Change Management and Stakeholder Engagement

Implementing a large-scale government IT project like CTAS, especially one that fundamentally alters business processes, inherently involves significant change management challenges. Taxpayers have already encountered issues with accessibility and authorizations during the CTAS transition. Building and maintaining public trust in the new system is paramount. This requires transparent communication about how data is collected, processed, and used, alongside accessible channels for taxpayers to raise concerns. Overcoming resistance from entrenched interests and established practices, particularly in areas like tax exemptions, also poses a significant political obstacle. Continuous system improvements and a commitment to addressing taxpayer concerns are vital to instill confidence and ensure efficient fulfillment of tax obligations.

Cost and Investment

The initial investment required for developing and implementing such advanced technological systems, including infrastructure upgrades and extensive training, can be substantial. While these investments are expected to yield long-term benefits in terms of improved compliance and increased state revenue, the upfront costs present a significant consideration for fiscal planning.

8. Conclusions and Recommendations

The “Triple Power of Integration”—the synergistic combination of the Core Tax Administration System (CTAS), the Tax Accounting Equation (TAE), the Self-Assessment Monitoring System (SAMS), and a modern Triple Entry Accounting System (TEAS)—represents a profound and potentially transformative leap for Indonesia’s tax administration. This initiative is not merely a technological upgrade; it signifies a fundamental philosophical shift from a reactive, audit-centric approach to a proactive, data-driven, and preventative compliance ecosystem. The integration promises to enhance accuracy, foster voluntary compliance through increased transparency and traceability, enable highly targeted enforcement, and significantly reduce administrative burdens. The ultimate objective is to bolster tax deposits and elevate Indonesia’s tax-to-GDP ratio, thereby strengthening the nation’s fiscal foundation for sustainable development.

However, the realization of this ambitious vision is complex and fraught with challenges. These include the uneven landscape of digital infrastructure, the intricate demands of data quality and interoperability, the necessity for agile regulatory adaptation, the critical need for human capital development, and the inherent complexities of large-scale change management within a public institution. Successfully navigating these obstacles will determine the extent to which Indonesia can harness the full potential of this integrated framework.

To ensure the successful implementation and long-term efficacy of the “Triple Power of Integration,” the following recommendations are put forth:

- Phased Implementation and Agile Development : The DGT should continue to adopt a phased implementation strategy, starting with pilot programs and scaling wisely. This agile approach allows for continuous refinement of the system based on real-world feedback and operational experiences, mitigating risks inherent in large-scale deployments.

- Targeted Infrastructure Investment : Prioritized investment in digital infrastructure is essential, particularly in rural and underserved areas, to bridge the digital divide and ensure equitable access to tax services. Concurrently, robust cybersecurity measures and digital forensics capabilities must be continuously enhanced to protect sensitive taxpayer data and maintain public trust.

- Comprehensive Human Capital Strategy : A multi-faceted human capital strategy is critical. This includes extensive training programs for DGT personnel to equip them with the necessary technical and analytical skills for the new system. Equally important are public tax literacy programs and accessible support channels to educate taxpayers, address their concerns, and facilitate their adaptation to digital tax processes.

- Proactive Regulatory Adaptation : The government must ensure that legal frameworks evolve in tandem with technological advancements. This involves continuously reviewing and harmonizing regulations to provide clear guidelines for digital transactions, address emerging concepts in the digital economy, and prevent legal uncertainties from hindering compliance.

- Robust Data Governance and Interoperability Frameworks : To overcome the “last-mile problem” and ensure seamless data exchange, the DGT should implement advanced data governance policies and interoperability frameworks. This includes exploring solutions like “reverse-ETL” and flexible self-service analytics platforms to empower tax officers with actionable data and enhance the reliability of insights derived from integrated systems.

- Sustained Stakeholder Engagement and Trust Building : Continuous, transparent communication and engagement with all stakeholders—taxpayers, businesses, financial institutions, and other government agencies—are paramount. Addressing concerns promptly, demonstrating the system’s benefits, and ensuring accountability will be key to fostering public confidence and encouraging voluntary compliance, ultimately solidifying the foundation for a modern and effective tax administration in Indonesia.

Reporter: Marshanda Gita – Pertapsi Muda